KCB Group has reported a post-tax profit of Sh16.53 billion for the first quarter ending March 2025, showing a slight rise from Sh16.48 billion recorded over the same period last year.

The results were supported by modest revenue growth and a stronger contribution from the bank’s regional operations.

Total income for the period stood at Sh49.4 billion, representing a 2 per cent increase.

The Group’s balance sheet also grew, closing at Sh2.03 trillion, up from Sh1.99 trillion, with the expansion attributed to stability in the loan book.

A notable shift in this quarter’s performance came from subsidiaries outside Kenya, which accounted for nearly a third, 32 per cent, of the Group’s profit before tax.

Read More

The bank said this reflected its continued focus on growing its regional footprint and tapping into broader East African markets.

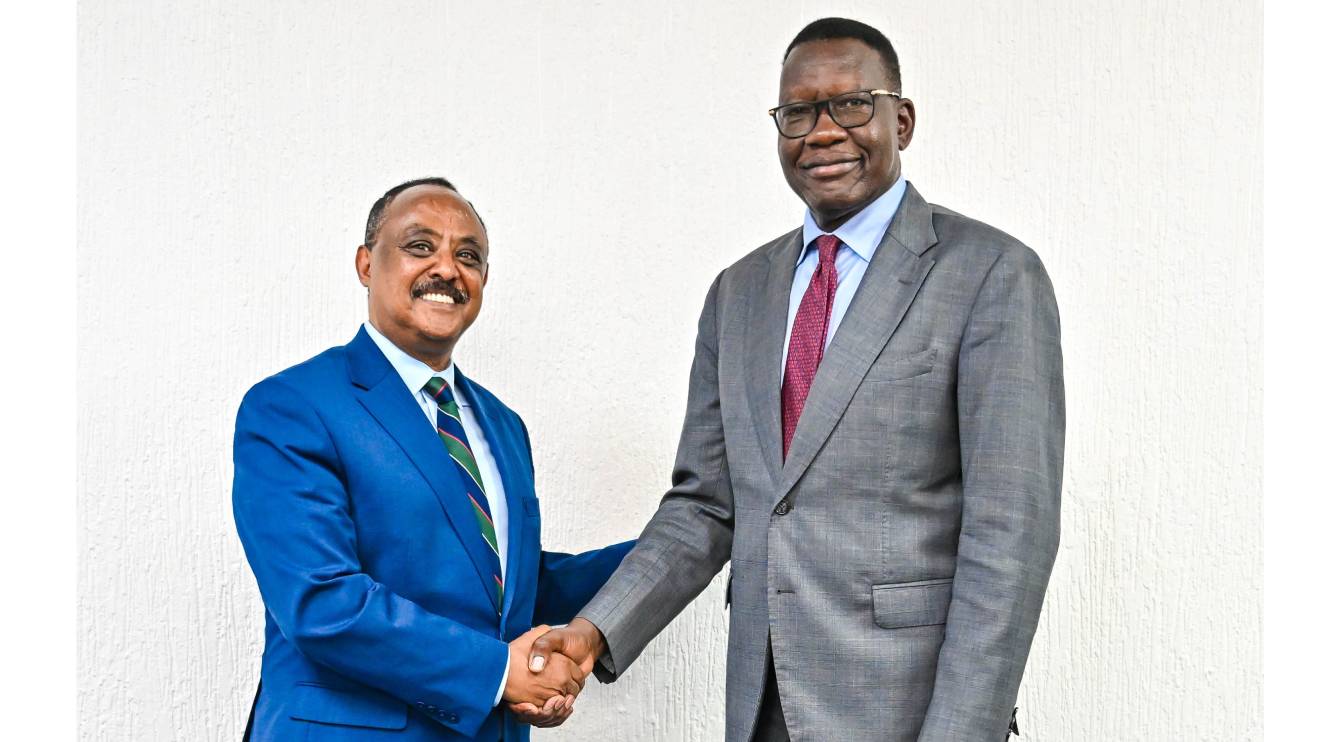

Commenting on the results, Group CEO Paul Russo highlighted the collective effort behind the performance.

“The quarter’s performance reflects a strong push by teams across the business. It is notable that we were able to match 2024 quarter one performance, which was impressive by all standards. The Group was resilient, supported by new business lines, deepening of digital channels and innovative customer value propositions," Russo stated.

"Our robust balance sheet means that we are well positioned to support our customers to navigate the general emerging challenges across the region."

He also outlined the Group’s priorities for the remainder of the year, noting that, “As we steer the remainder of the year, our focus is on leveraging the Group’s scale, capabilities, people and partners, to deepen relationships and financial inclusion. We will continue to harness technology to enhance banking services and drive relevant products and services that contribute to economic growth, sustainability, and shareholder value.”

The quarter saw operating costs rise by 7.8 per cent to Sh22.7 billion, driven mainly by employee expenses and planned technology investments.

Meanwhile, provisions for loan losses dropped by 11.3 per cent.

This was linked to stricter monitoring of at-risk accounts, improved recovery on defaulted loans, and stronger collateral cover.

However, the level of gross non-performing loans remained high, closing the quarter at Sh233 billion, with the NPL ratio standing at 19.3 per cent—an indicator of continued pressure in several sectors across the region.

Customer deposits reached Sh1.4 trillion, while total customer loans and advances ended the period at Sh1.02 trillion.

The latter figure was slightly affected by currency movements, particularly the strengthening of the Kenyan Shilling.

Return on equity stood at 23.3 per cent, while shareholder equity jumped 28.4 per cent to Sh297.1 billion, up from Sh231.5 billion.

The Group said it maintained strong capital levels, with core capital at 16.7 per cent of total risk-weighted assets—well above the minimum required 10.5 per cent.

Its total capital adequacy ratio was 19.7 per cent, against a regulatory threshold of 14.5 per cent.

With the exception of the National Bank of Kenya (NBK), all banking subsidiaries remained in compliance with their local capital requirements.

KCB Group Chairman Dr Joseph Kinyua acknowledged the challenges in the operating environment but said the bank had maintained its footing.

“In the face of a challenging operating environment, KCB has demonstrated remarkable resilience and robust performance, underscoring the strength of our fundamentals, strategic direction, and leadership depth," Kinyua remarked.

"The environment is expected to be even tougher this year with all the headwinds streaming from global trade tariff wars to shifting geopolitics in the East region. KCB Group remains dedicated to ensuring long-term sustainability and shared value for all stakeholders."

Shareholders had every reason to smile as Return on Equity surged to 23.3 per cent.

Group equity leapt 28.4 per cent to Sh297.1 billion, while capital buffers across all subsidiaries (save for NBK) remained above regulatory thresholds.

-1756319289.jpg)