The Kenya Revenue Authority (KRA) has announced a new filing process that will spare salaried workers the hassle of manually entering their annual income details when submitting tax returns.

Under the change, taxpayers will only need to provide their National Identification numbers on the iTax platform, which will then automatically generate records such as gross pay and statutory deductions for the relevant year.

This replaces the old method where employees had to key in figures from employer-issued P9 forms.

KRA explained that the improvement stems from integrating its internal tax systems with other government databases, part of a wider push to make compliance easier for individuals and businesses alike.

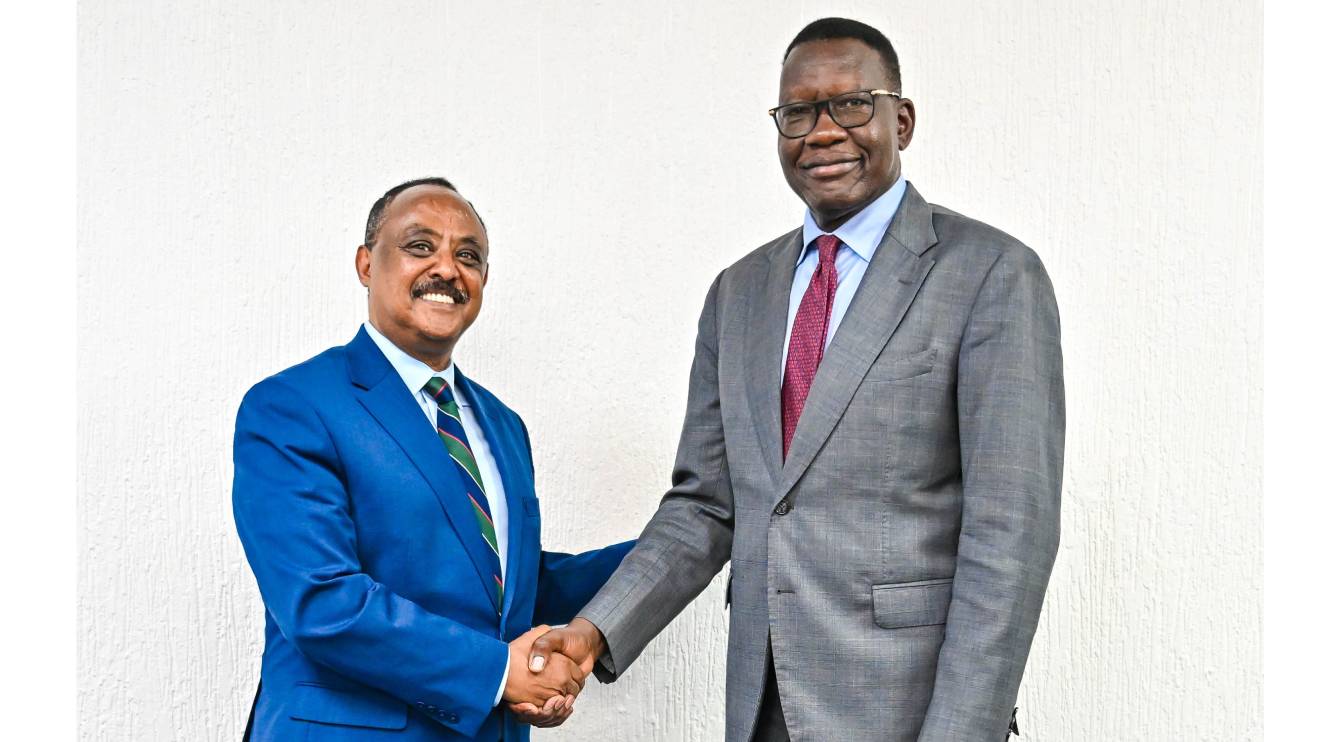

Commissioner General Humphrey Wattang'a highlighted the importance of better use of information in the new approach.

Read More

"Data is going to become, or has become, our greatest asset, so we want to see how we integrate it into various data systems internally so that we do not have siloed systems but integrated systems," Wattanga stated.

He added that this is only one element of KRA’s broader agenda.

"For instance, we want to integrate with business registration systems and citizen registration systems so that we can easily prepopulate data."

Wattang'a further remarked that the Authority’s plans are informed by collaboration with other agencies.

"Our strategy and our digitisation journey are highly informed by what has been developed through our engagements with government agencies," he said.

The announcement comes less than two months after the closure of the iTax portal for filing 2024 returns, signalling the start of a smoother and more automated process in the year ahead.

-1753733469.jpeg)

(1)-1756392932.jpg)