NCBA Group has reported a profit after tax of Sh11.1 billion for the first half of 2025, marking a 12.6 per cent rise from Sh9.8 billion posted during the same period last year.

Profit before tax increased by 11.4 per cent to Sh13.6 billion, while operating income grew 12.7 per cent to Sh35.3 billion.

Operating expenses also increased 12.5 per cent to Sh18.6 billion, and provisions for credit losses stood at Sh3.2 billion, a 19.1 per cent jump year-on-year.

Digital lending continued to drive NCBA’s growth, with Sh646 billion disbursed, up 35 per cent.

However, customer deposits slipped 6 per cent to Sh497 billion, while total assets declined 3.8 per cent to Sh663 billion.

Read More

The strong results prompted the board to declare an interim dividend of Sh2.50 per share.

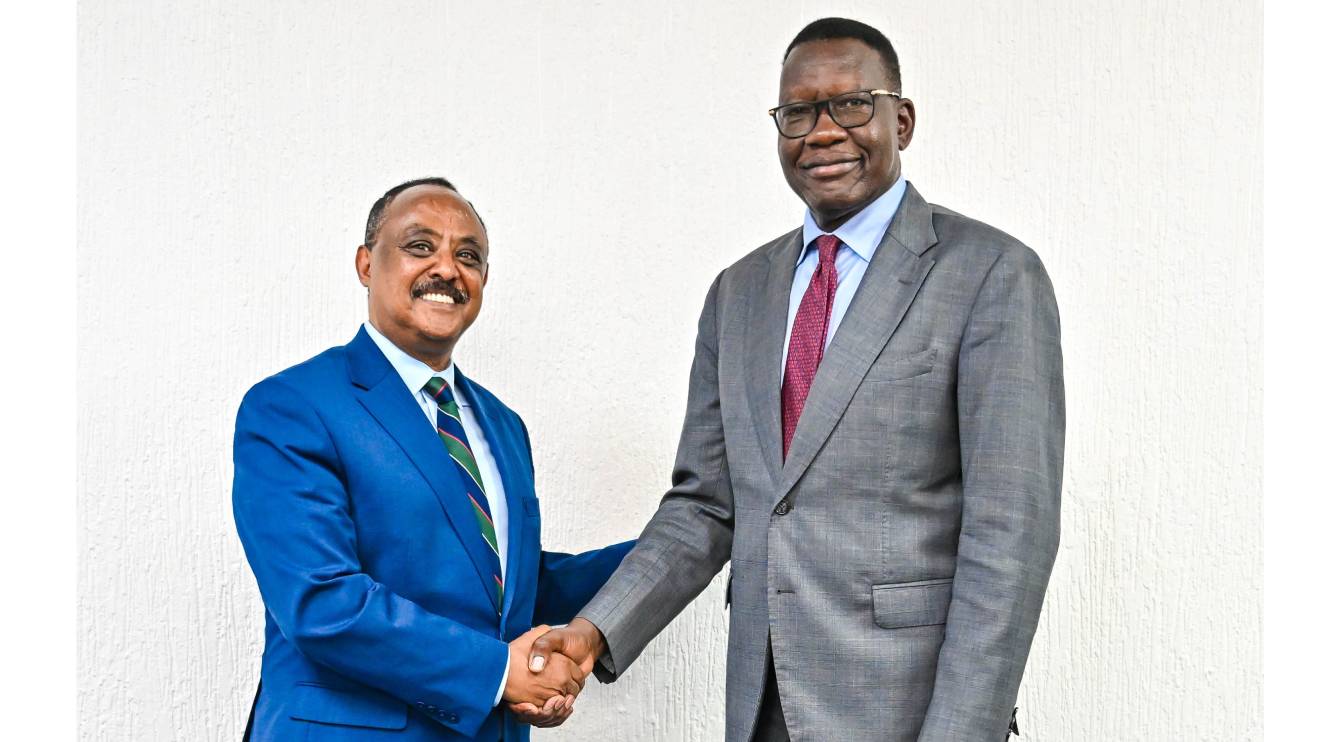

NCBA Group MD John Gachora said the half year 2025 financial results highlighted a rebound and a positive momentum in the Group’s business performance.

“The income growth of 13 per cent was driven by a combination of operational excellence and prudent pricing management despite a challenging economic environment,” said Gachora.

He noted that asset quality remained stable, with an NPL ratio of 11.9 per cent and a cost of risk of 1.4 per cent, while the capital adequacy ratio stood at 22.4 per cent, well above regulatory requirements.

“In our mission to make customers’ lives easier, NCBA Bank Kenya Shillings Base Lending Rate (NBLR) since August 2024 has dropped by 4.02 per cent while over the same period, the CBR has dropped by 3.50 per cent,” he added.

NCBA Bank Kenya contributed 81 per cent of Group profitability after posting a 7.4 per cent year-on-year rise in profit before tax to Sh11 billion, powered by lower funding costs and a 32 per cent increase in net interest income.

Regional subsidiaries delivered Sh1.8 billion in PBT, accounting for 13.6 per cent of Group earnings, while non-banking units grew strongly, posting Sh804 million in PBT, a 40 per cent rise.

NCBA Investment Bank surpassed 50,000 clients through digital onboarding, with assets under management climbing to Sh86 billion.

Meanwhile, NCBA Insurance posted a 68 per cent surge in profitability following its full integration into the Group.

The Group expanded its footprint to 122 branches, with Kenya crossing the 100-branch milestone after opening a new outlet at Nord Mall, Ruiru.

Its customer base grew to 412,000 core bank clients, while the overall customer base neared the 70 million mark, boosted by digital account onboarding, diaspora and SME banking, and the waiver of monthly account fees.

In asset finance, NCBA retained its lead with a 31 per cent market share, supported by innovations such as the enhanced CarDuka digital platform, which now offers insurance products and an AI-powered interface.

Corporate clients also embraced the upgraded ConnectPlus platform, with over 90 per cent of active users now benefiting from faster transactions, expanded payment options, and advanced cash management tools.

Gachora said NCBA is optimistic about the operating environment, citing a stable shilling, inflation within target, and a positive global growth outlook.

“NCBA remains committed to delivering strong financial performance backed by continued strategic investments in people, technology and brand while fostering a customer-obsessed culture to drive sustainable growth.”

-1753733469.jpeg)